#UXUIdesign

#mobile

#desktop

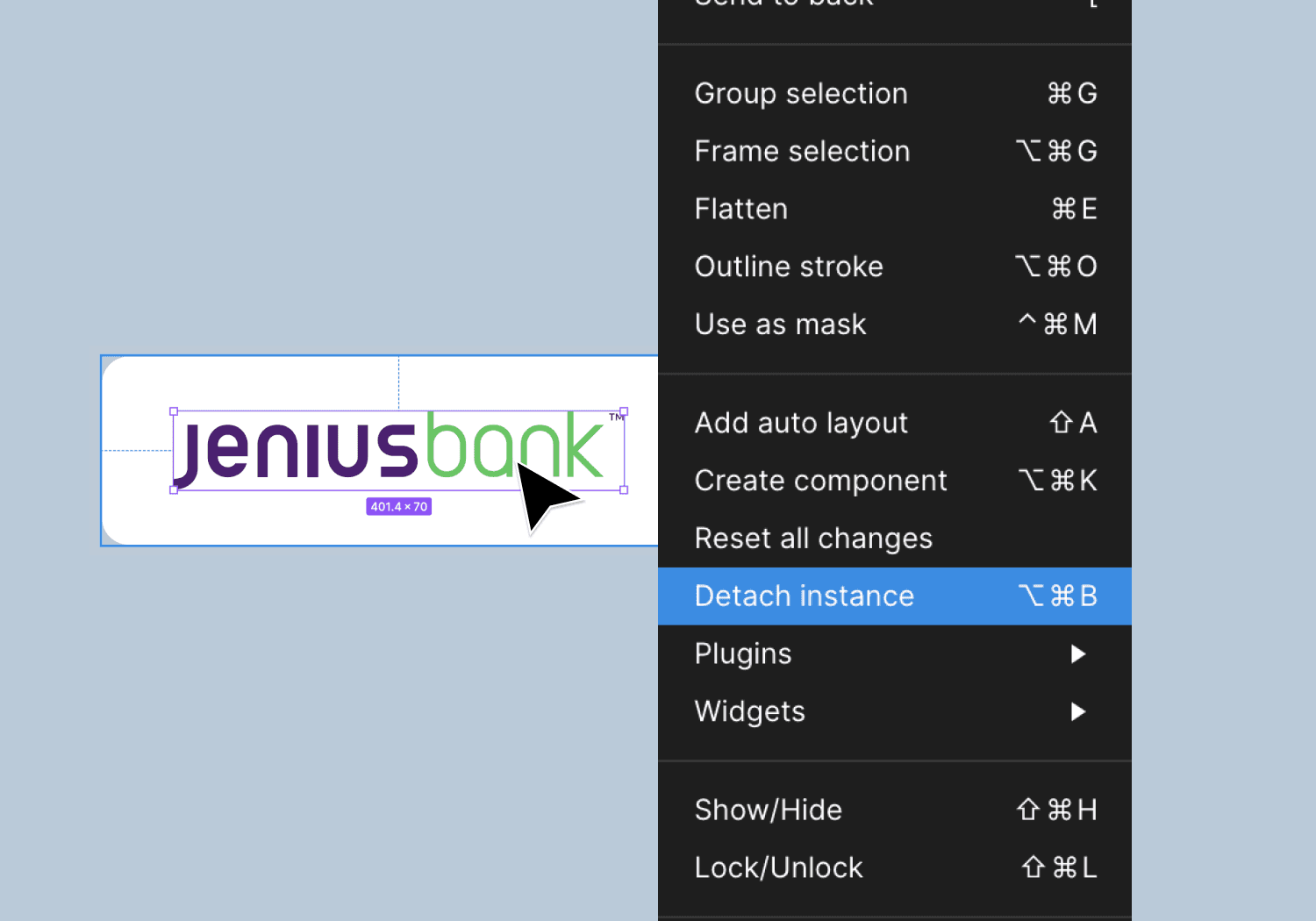

#Figma

Jenius Bank - Core Banking Features

Jenius Bank - Core Banking Features

Jenius Bank - Core Banking Features

Jenius Bank - Core Banking Features

Jenius Bank - Core Banking Features

Jenius Bank - Core Banking Features

In 2023, our company embarked on a significant transition, migrating from our old core platform to develop a new mobile and desktop application from the ground up. This transition provided us the freedom to define our own brand styles and design patterns while creating an opportunity to revisit and address existing user pain points. Partnering closely with product, research, complaints, and engineering teams, I worked to enhance and elevate the core banking experiences outlined below.

In 2023, our company embarked on a significant transition, migrating from our old core platform to develop a new mobile and desktop application from the ground up. This transition provided us the freedom to define our own brand styles and design patterns while creating an opportunity to revisit and address existing user pain points. Partnering closely with product, research, complaints, and engineering teams, I worked to enhance and elevate the core banking experiences outlined below.

In 2023, our company embarked on a significant transition, migrating from our old core platform to develop a new mobile and desktop application from the ground up. This transition provided us the freedom to define our own brand styles and design patterns while creating an opportunity to revisit and address existing user pain points. Partnering closely with product, research, complaints, and engineering teams, I worked to enhance and elevate the core banking experiences outlined below.

In 2023, our company embarked on a significant transition, migrating from our old core platform to develop a new mobile and desktop application from the ground up. This transition provided us the freedom to define our own brand styles and design patterns while creating an opportunity to revisit and address existing user pain points. Partnering closely with product, research, complaints, and engineering teams, I worked to enhance and elevate the core banking experiences outlined below.

In 2023, our company embarked on a significant transition, migrating from our old core platform to develop a new mobile and desktop application from the ground up. This transition provided us the freedom to define our own brand styles and design patterns while creating an opportunity to revisit and address existing user pain points. Partnering closely with product, research, complaints, and engineering teams, I worked to enhance and elevate the core banking experiences outlined below.

In 2023, our company embarked on a significant transition, migrating from our old core platform to develop a new mobile and desktop application from the ground up. This transition provided us the freedom to define our own brand styles and design patterns while creating an opportunity to revisit and address existing user pain points. Partnering closely with product, research, complaints, and engineering teams, I worked to enhance and elevate the core banking experiences outlined below.

October 2023 - Present

Timeline

Lead Designer

Role

October 2023 - Present

Timeline

Lead Designer

Role

About Jenius Bank

My Role at Jenius

About Jenius Bank

My Role at Jenius

About Jenius Bank

My Role at Jenius

About Jenius Bank

My Role at Jenius

About Jenius Bank

My Role at Jenius

Loan Payments

Loan Payments

One of the most complex features I worked on was the loan payments project, where the primary design goal was to provide users with clear and intuitive information about intricate payment timelines and scenarios.

Designing this feature required extensive cross-functional collaboration, particularly with business and legal teams, to thoroughly understand the regulatory requirements and payment processing rules. Given the variability in payment timing—such as differences based on whether payments fell within or outside the billing cycle— or how existing AutoPay arrangements impact your new payment, it was crucial to align with engineering teams to map out system behaviors accurately.

Initially, these nuances were not clearly communicated to users, leading to significant complaint volume. By addressing these complexities, we were able to improve transparency and deliver a more user-friendly experience.

I partnered with our research team to create and test robust prototypes with users. Reports showed that it was well received and clear how to navigate payments!

One of the most complex features I worked on was the loan payments project, where the primary design goal was to provide users with clear and intuitive information about intricate payment timelines and scenarios.

Designing this feature required extensive cross-functional collaboration, particularly with business and legal teams, to thoroughly understand the regulatory requirements and payment processing rules. Given the variability in payment timing—such as differences based on whether payments fell within or outside the billing cycle— or how existing AutoPay arrangements impact your new payment, it was crucial to align with engineering teams to map out system behaviors accurately.

Initially, these nuances were not clearly communicated to users, leading to significant complaint volume. By addressing these complexities, we were able to improve transparency and deliver a more user-friendly experience.

I partnered with our research team to create and test robust prototypes with users. Reports showed that it was well received and clear how to navigate payments!

Transfers

Transfers

Like payments, transfers is one of the most critical and frequently used functions in our savings accounts, and would be necessary to scale for future product lines. It was essential to design a seamless, reliable flow while simultaneously making improvements based on D1's user feedback - including unclear transfer timelines and cutoff limitations, making it difficult to confidently schedule future transfers.

Redesigning this feature required a user-centered approach to improve clarity and reliability, ensuring users could fully trust and depend on the system.

Like payments, transfers is one of the most critical and frequently used functions in our savings accounts, and would be necessary to scale for future product lines. It was essential to design a seamless, reliable flow while simultaneously making improvements based on D1's user feedback - including unclear transfer timelines and cutoff limitations, making it difficult to confidently schedule future transfers.

Redesigning this feature required a user-centered approach to improve clarity and reliability, ensuring users could fully trust and depend on the system.

AutoPay

AutoPay

AutoPay is a key feature that reinforces our brand as a bank dedicated to simplifying and supporting customers' financial journeys. By enabling users to automate payments effortlessly, it allows them to focus on their goals while we handle the details.

To enhance the AutoPay experience, I conducted a thorough audit of all areas where AutoPay status could be viewed and managed, ensuring a consistent and intuitive experience across the app. This included the dashboard, payments section, and scheduled transactions for individual accounts. I also partnered closely with the complaints team to analyze logs of AutoPay issues, identifying critical pain points and opportunities for improvement. Although the feature appears visually simple, its success relied on addressing underlying complexities to provide users confidence in their financial automation.

AutoPay is a key feature that reinforces our brand as a bank dedicated to simplifying and supporting customers' financial journeys. By enabling users to automate payments effortlessly, it allows them to focus on their goals while we handle the details.

To enhance the AutoPay experience, I conducted a thorough audit of all areas where AutoPay status could be viewed and managed, ensuring a consistent and intuitive experience across the app. This included the dashboard, payments section, and scheduled transactions for individual accounts. I also partnered closely with the complaints team to analyze logs of AutoPay issues, identifying critical pain points and opportunities for improvement. Although the feature appears visually simple, its success relied on addressing underlying complexities to provide users confidence in their financial automation.

External Accounts Management

External Accounts Management

Managing external accounts involves enabling users to add, verify (via trial deposits), remove, and view account details. A key challenge in redesigning this feature was addressing the wide range of decline reasons that could occur during the account addition process. To improve the user experience, I focused on providing clear and actionable explanations (where permitted) to help users understand the status of their external account connections.

Additionally, the ability to add accounts needed to be seamlessly integrated across various app sections, including payments and transfers. It was crucial to ensure these designs were adaptable and intuitive, enhancing functionality without distracting users or causing drop-off from their primary tasks.

Managing external accounts involves enabling users to add, verify (via trial deposits), remove, and view account details. A key challenge in redesigning this feature was addressing the wide range of decline reasons that could occur during the account addition process. To improve the user experience, I focused on providing clear and actionable explanations (where permitted) to help users understand the status of their external account connections.

Additionally, the ability to add accounts needed to be seamlessly integrated across various app sections, including payments and transfers. It was crucial to ensure these designs were adaptable and intuitive, enhancing functionality without distracting users or causing drop-off from their primary tasks.

Account Alerts

Account Alerts

Alerts empower users to customize notifications on a per-account basis, enabling them to set dollar amount thresholds and choose their preferred device for receiving notifications. As part of the redesign, I reorganized the display of alerts to improve clarity and usability. I also updated the interaction pattern for managing alert settings, ensuring a more intuitive and streamlined user experience.

Alerts empower users to customize notifications on a per-account basis, enabling them to set dollar amount thresholds and choose their preferred device for receiving notifications. As part of the redesign, I reorganized the display of alerts to improve clarity and usability. I also updated the interaction pattern for managing alert settings, ensuring a more intuitive and streamlined user experience.

Tasks & Shortcuts

Tasks & Shortcuts

I led the design strategy for this net-new feature, which was not included in the original D1 build. Aligned with our mission to help users achieve their financial goals, tasks provided personalized, dynamic, and suggestions, such as making on-time payments or verifying external accounts. By leveraging existing APIs that powered other areas of the app, we delivered meaningful value while balancing technical feasibility with improved user experiences.

Shortcuts complemented this feature as a key navigational tool, bringing the most commonly used actions front and center to streamline how users interact with their bank accounts by meeting them where they are.

I led the design strategy for this net-new feature, which was not included in the original D1 build. Aligned with our mission to help users achieve their financial goals, tasks provided personalized, dynamic, and suggestions, such as making on-time payments or verifying external accounts. By leveraging existing APIs that powered other areas of the app, we delivered meaningful value while balancing technical feasibility with improved user experiences.

Shortcuts complemented this feature as a key navigational tool, bringing the most commonly used actions front and center to streamline how users interact with their bank accounts by meeting them where they are.

What's next?

What's next?

Collaborating closely with cross-functional partners has been the highlight of these projects, offering invaluable insights into what it takes to power each feature and how I can effectively bridge the gap between our business objectives and customer needs.

While not every project had the resources or timeline for full user testing before development, the next step for each feature is to evaluate customer responses through a robust set of metrics documented by our product team. This data-driven approach will help refine and further enhance the user experience.

Collaborating closely with cross-functional partners has been the highlight of these projects, offering invaluable insights into what it takes to power each feature and how I can effectively bridge the gap between our business objectives and customer needs.

While not every project had the resources or timeline for full user testing before development, the next step for each feature is to evaluate customer responses through a robust set of metrics documented by our product team. This data-driven approach will help refine and further enhance the user experience.